On 17th august 1998, financial crisis had hit Russia. It occurred just when economic development and macroeconomic stabilization began to succeed. Since the 1980’s, the year 1997 was the first year, when positive GDP growth was recorded. The rate of inflation reduced to 11% which was a low figure compared to the inflation rates in the first half of 1990’s, because of this reduction in inflation, the real interest rates also reduced. This created a positive environment which attracted the investors.

But by May of 1998, Russia started experiencing fall in GDP, increasing Inflation and increasing Unemployment. The inflation rate hit 84.4% from 11% in 1997. The purchasing power of the holders of Ruble declined because of high inflation rate. The interest rates also increased sharply because of the loss of confidence of investors. The government deficit could not be financed because of high interest rates. The Russian government was forced to devalue the ruble, because of the ongoing crisis. Such a move was expected to boost exports and reduce trade deficits. This crisis was caused by Russian government’s failure to address fiscal imbalance. The tax system was ineffective and it failed to generate sufficient revenues. This crisis had a huge impact on Russian economy and derailed the Russia’s course towards market economy.

Economic Background

The economic restructuring in Russia was marked by prolonged depression and instability. Between the years 1987 and 1996 there were several instances of near- hyperinflation. With the help of international monetary fund, a stabilization programme was introduced in 1995 to control the inflation. If focused on tightening monetary control and achieving exchange rate targets. In the following years Russia had made progress towards stability of prices and exchange rate, because of this stability, the rest of the countries thought that Russia was on the right course of reforms. Russia emerged from USSR, after it’s dissolution, and it inherited it’s seat in UN and its responsibilities. Russia also inherited its industries which were unproductive heavy industries. Subsidies which were given earlier to poor people was now removed and the prices were liberalized which led to the destruction of existing capital stock. Since the restructuring was carried out through market forces and not by government directed industrial policies. It led to the virtual disappearance of the entire industry. This was called the largest garage sale in history, because value industries were undervalued and sold at throwaway prices. (Contemporary World Poltics , 2016)

The private investors who bought these industries had no interest or incentive to develop these industries. Therefore, restructuring of these industries was not possible. The legislative and institutional reforms in Russian in the 1990’s was meagre, and the new market structure was extremely weak. The administration in Russian was slow and it supressed ordinary people, it was filled with rampant corruption, it was not willing to make amends to the mistakes it had made. The administration was unwilling to allow more openness in the government. This led to the concentration of wealth in the hands of few people. These people in turn used their power to influence administrators and regulatory bodies.

This section of the society didn’t acquire wealth through entrepreneurial success, it was obtained from illegal or semi-legal activities. These people did not have the spirit of entrepreneurship, they just spent the money they had on expensive imports, or real estate. Therefore, none of this money was put to productive use which benefitted the country. The government announced the stabilisation policies of 1995 in such an economic context. Even though the inflation reduced, the investment in the country remained hostile because of the negative environment. This led to the fall in investment in productive industries, which in turn weakened the sources of future growth.

After a meagre recovery in 1997, the financial situation in Russia started to deteriorate again. Exports of energy resources was the main source of income for the country. The Asian crisis of 1997, came as a big blow for the country. The prices and demand for these resources reduced. The income earned from exports thereby witnessed a steep decline, which had a huge impact on Russia’s balance of payment. The tightening of fiscal policy further deteriorated the situation.

Fiscal Background.

By mid-1998 liquidity in international markets had reduced and Russia’s current account balance further deteriorated as oil prices continued to fall internationally. The interest rates in Russia increased by 150% in 1998, the government tried to address this situation by devaluing the Ruble. They used a floating peg system, with which the central bank kept the exchange rate between ruble and dollar within a certain range. When the ruble fell below the range the central bank used to sell foreign reserves, so as to create demand for ruble and pull its value back up. This practice proved useful only for a short period, as the central bank started running out of foreign exchange reserves needed to stabilize the currency. In addition to this the government also issued a 90-day moratorium on payments by commercial banks to foreign creditors. In September of 1998, the government realized that they could no longer use their reserves to stabilize the value of the currency. So, they instead took a decision to devaluate the currency. Because of this decision the Russian stock market and bonds collapsed. The domestic debt, the government had to pay had risen to 40$ billion.

The inflation started to rise again, and because of this the savings done by the people in the country became worthless, as they had to now spend more money to get the same amount of goods. The cost of imports rose more than 400% and the prices of food items increased by more than 100%. The businesses also stopped their employees, because of the loses they were occurring. This increased unemployment and pushed about 30% of the Russian population below the poverty line. Most of the regions In Russia were dependent on their industries, so they took the biggest blow.

The agriculture sector was already declining because of unsuccessful and delayed reforms, concerning privatization. The investment in fertilizers and agricultural tools was also minimal. There were massive food shortages everywhere. In some states the leaders obstructed the export of food from their region to another within the country. In cities rationing was implemented, but no one cared about the countryside. Many people stopped paying taxes to the government, and some regional governments stated taking control of local assets. Many regions came together to set up their own banking system, to support each other and change currencies. This was against the federal law at that time. Many regions also pleaded for financial assistance from abroad. Most of the banks shut down during this period. The reason behind the shutdown was that, many people started approaching banks to withdraw their deposits. The demand of withdrawal exceeded the amount of money the banks had with themselves. The emergency measures were issued which put a halt on the withdrawals. Therefore, we can see how each and every sector was affected by this crisis ranging from food industry to labor industry to banking industry.

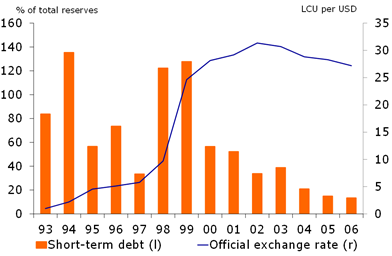

From this graph we can see how the debt kept on increasing from year to year and how the value of the ruble was depreciating or how the exchange rate was increasing.

The financial crisis of 1998.

By mid-1998 liquidity in international markets had reduced and Russia’s current account balance further deteriorated as oil prices continued to fall internationally. The interest rates in Russia increased by 150% in 1998, the government tried to address this situation by devaluing the Ruble. They used a floating peg system, with which the central bank kept the exchange rate between ruble and dollar within a certain range. When the ruble fell below the range the central bank used to sell foreign reserves, so as to create demand for ruble and pull its value back up. This practise proved useful only for a short period, as the central bank started running out of foreign exchange reserves needed to stabilize the currency. In addition to this the government also issued a 90-day moratorium on payments by commercial banks to foreign creditors. In September of 1998, the government realised that they could no longer use their reserves to stabilize the value of the currency. So, they instead took a decision to devaluate the currency. Because of this decision the Russian stock market and bonds collapsed. The domestic debt, the government had to pay had risen to 40$ billion.

The inflation started to rise again, and because of this the savings done by the people in the country became worthless, as they had to now spend more money to get the same amount of goods. The cost of imports rose more than 400% and the prices of food items increased by more than 100%. The businesses also stopped their employees, because of the loses they were occurring. This increased unemployment and pushed about 30% of the Russian population below the poverty line. Most of the regions In Russia were dependent on their industries, so they took the biggest blow. The agriculture sector was already declining because of unsuccessful and delayed reforms, concerning privatization. The investment in fertilizers and agricultural tools was also minimal. There were massive food shortages everywhere. In some states the leaders obstructed the export of food from their region to another within the country. In cities rationing was implemented, but no one cared about the countryside. Many people stopped paying taxes to the government, and some regional governments stated taking control of local assets.

Many regions came together to set up their own banking system, to support each other and change currencies. This was against the federal law at that time. Many regions also pleaded for financial assistance from abroad. Most of the banks shut down during this period. The reason behind the shutdown was that, many people started approaching banks to withdraw their deposits. The demand of withdrawal exceeded the amount of money the banks had with themselves. The emergency measures were issued which put a halt on the withdrawals. Therefore, we can see how each and every sector was affected by this crisis ranging from food industry to labour industry to banking industry.

Source: – International monetary fund.

From this graph we can see how the inflation in Russia reached its peak during the crisis.

Policies.

Firstly, I think the tax regime should have been re-established with proper guidelines. The punishment and fines should also have been strictly laid out. The number of taxes collected should have been restricted, so that tax evasion would reduce. This would have ensured a secured flow of income to the government, thereby reducing the deficit. Special policies should have been exercised with regard to private investors who bought the state’s heavy industries. Increased production of these industries would increase the GDP of the country, which in turn means more income for the government in terms of taxes.

Privatisation should have been systematically like the one in china, privatizing one industry after an another. These industries should have been sold more carefully, to those investors who really had interest and funds. Such a move would have increased the productivity of these industries. Productivity of public sector enterprises such as energy, gas and oil etc, should have been increased through strict regulation and transparency. These regulations would have prevented corruption in the system and the transparency would help each and every person know where the money is going and what activities are being performed. Transparency is the main component of democracy. This would also help create a positive environment, which would in turn induce or attract foreign investors.

Non plan expenditure should have been reduced. If this type of expenditure was reduced then, the extra money which was saved could have been used to reduce the deficit. The construction of democratic institutions was not given the same attention as economic transformation. The foundation of these institutions should have been strengthened, when the symptoms of the crisis occurred before 1998. The government should have allowed more openness and transparency. This would have allowed the citizens to question and criticize the leaders. Corruption could have been eliminated. Instead of stopping the salaries of workers and giving pensions to old people, the government could have asked other countries for help. The government should have tried to raise money by asking other countries for help, on reasonable terms. This would have been a better alternative than stopping salaries.

The government should have promoted foreign direct investment into the country, by giving these companies tax benefits and providing them area in special economic zones. This would have helped in the development of infrastructure and would have increased the GDP of the country.

If the salaries were not ceased then, these workers would have actively contributed to the GDP. The government should have kept the interest rate under control, the businessmen and individuals would have borrowed money and would have spent it on goods and services. In this case these funds could also have been used to replace worn out capital assets and build new infrastructure. I know that the interest rates were increased to reduce inflation, but as we can see this policy failed as it began to rise again. In this case there is a trade-off between inflation and interest rates. But since increasing interest rates didn’t work, the alternate seems more practical and workable. Inflation targeting should have been adopted by the government to bring inflation under control. The government should have employed these workers to build new and improved infrastructure. This way the government would have created employment and increased the standard of living. This would have improved the overall condition of the citizens in the country.

References

Aris, B. (2018, august 18). Remembering Russia’s 1998 Financial Crisis. Retrieved from The Moscow Times : https://www.themoscowtimes.com/2018/08/22/remembering-russias-1998-financial-crash-op-ed-a62595

Cohen, A. (1999, June 18). What Russia Must Do to Recover from its Economic Crisis. Retrieved from The Heritage Foundation: https://www.heritage.org/europe/report/what-russia-must-do-recover-its-economic-crisis

Desai, P. (n.d.). The American Economic Review. Why Did the Ruble Collapse in August 1998.

Russia’s 1998 Financial Crisis in the Regions: A Case Study. (2014, jan 14). Retrieved from Stratfor: https://worldview.stratfor.com/article/russias-1998-financial-crisis-regions-case-study

Service, C. R. (1999). The Russian Financial Crisis of 1998: An analysis of trends, causes and implications. .

The Russian Crisis 1998. (2013, september 16). Retrieved from Rabo Research : https://economics.rabobank.com/publications/2013/september/the-russian-crisis-1998/

UNCTAD. (1998). THE RUSSIAN CRISIS. Geneva.

Very well thought out and put together literature review.

LikeLike

Brilliant research

LikeLike

Great work

LikeLike

Well written.

LikeLike